SAVVY Australians looking to maximum their tax breaks this financial year have only today left to do so.

There’s less than 24 hours to go until we enter the 2015/16 financial year but experts say there’s still some last-minute actions people can take to help reduce their tax bill.

The Australian Taxation Office said optimising the instant asset write-off threshold — it recently increased from $1000 to $20,000 — means taxpayers can immediately claim a deduction for their business assets that cost less than $20,000.

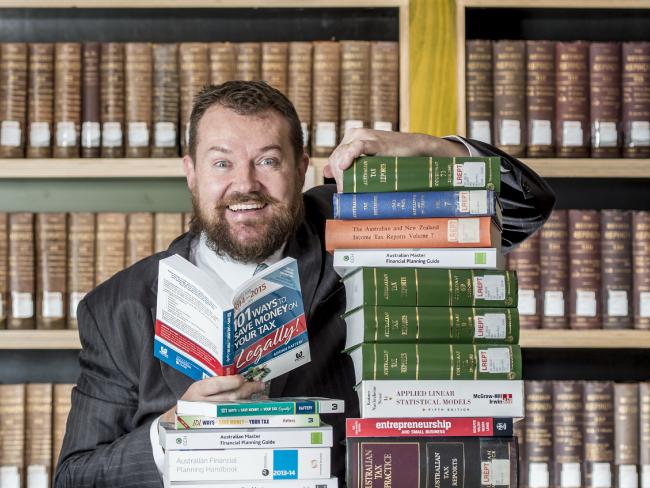

Deakin University’s senior lecturer in taxation Adrian Raftery ... He said there are multiple things Australians can do on June 30 to maximise their tax breaks.

But Deakin University’s senior lecturer in taxation, Adrian Raftery, warns Australians not to go out and buy last-minute items today without thinking it through first.

“You are not going to get the full $20,000 back, you are only getting a percentage based on your tax rate, if they are a small company they are only to get a maximum of $6000 back,’’ he said.

“Don’t go out and buy a company car with this $20,000 because you’ll get slugged with fringe benefits tax, basically 20 per cent of the purchase price of the car ($4000 per annum versus $6000 of a tax rebate).”

The ATO’s assistant commissioner Graham Whyte is also warning Australians to be diligent with their record-keeping of purchases made.

“Our big tip for small businesses planning to claim an immediate deduction is to keep records of their purchase,’’ he said.

We’re currently working with small business looking to use the immediate deduction to ensure they are claiming appropriately.

“We’re monitoring claims made and following up on high-risk cases.”

For low-income earners whose taxable income is below $37,000 per annum, Mr Raftery said it would be well worth tipping money into their super fund in order to receive the low income superannuation contribution.

“If you are a low-income earner and make a $1000 co-contribution into your superannuation, you’ll potentially get $500 in your super account — that’s a 50 per cent return, free money,’’ he said.

Australians should also consider prepaying any expenses today that are tax-deductible, for example newspaper and magazine subscriptions and professional memberships.

For those using their car for work, it’s a good idea to start your 12-week log book from today and the amount claimed during this period will go towards return for the 2014/15 financial year.

Mr Raftery also said many shareholders with stocks that are losing them money will be likely to sell their shares today so they can crystallise any losses against the capital gains made.

Donations to charity will also give taxpayers a deduction this financial year.

Health insurers are also offering an array of incentives to join up by banking on the fact high-income earners will avoid the Medicare Levy Surcharge if they take out private health cover.

To avoid the surcharge the insurance must be held for the entire year otherwise it will be perorated.

Farmers also make immediate deductions for money spent after May 12 this year on fencing and water facilities such as dams, tanks, bores and pumps.

Originally published as How you can reduce your tax bill

Article published in Perth Now for The Sunday Times on 30 June 2015