MONEY mistakes made in the next month can potentially cost you plenty at tax time.

While July is still a month away, taxpayers should be aware of the errors in June that can create financial pain — particularly around the timing of tax-deductible payments and selling assets.

With investment or work-related expenses, delaying them until July means waiting an extra year to get a slice of that money back from the taxman.

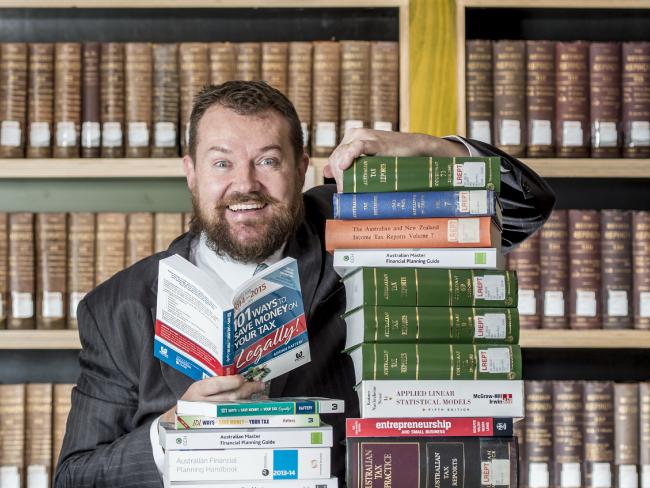

Deakin University Business School associate professor Adrian Raftery said delaying tax-deductible expenses and failing to keep records were two common errors.

Dr Raftery said many retailers were savvy in June and promoted tax deductions as part of their end-of-financial-year sales.

“However, don’t go out and buy something purely for a tax deduction. Don’t buy a new printer for your home office if you don’t need it,” he said. A tax deduction only gives you back your marginal tax rate, not the entire expense.

Individuals buying items for work or investment properties should also be aware than anything costing more than $300 could not be claimed instantly and would have to be written off over time, Dr Raftery said. Business owners get a much more generous $20,000 limit per item for immediate tax write-offs.

Trying to trick the Australian Taxation Office with dodgy purchases and deductions is another mistake.

Peter Bembrick, a tax partner at HLB Mann Judd Sydney, said the ATO had improved its ability to spot patterns in deductions and track down those trying to cheat the system.

Another mistake made by investors is selling poorly-performing shares in June to lock in capital losses, and then re-buying the same shares quickly. This is known as a wash sale and is not allowed.

Mr Bembrick said the timing of capital gains tax events, such as selling property or shares, was open to errors.

“If you incur a capital gain this financial year and a capital loss next year, you have done it the wrong way around. Ideally you want a loss that offsets the gain,” he said.

For CGT purposes, property sales are based on the date of the contract, not the settlement date — which may be in the new financial year — so plan carefully.

“It’s something that people don’t always understand,” Mr Bembrick said.

Superannuation limits also need to be monitored during June, particularly for personal tax-deductible contributions made by business owners. Mr Bembrick said if people’s payments went over the contributions caps, it could be “messy and costly” to fix.

Originally published as The tax errors you should avoid

Article published here by News Corp Australia Network in The Advertiser on 29 May 2017