Jeep ambassador Jesinta Campbell and her Jeep Cherokee.

EXCLUSIVE: The $30-million scandal engulfing motoring giant Fiat Chrysler Australia could go all the way to Detroit, taking in executives at the highest level.

News Corp Australia has learned all of the invoices signed off by former chief executives Clyde Campbell and Veronica Johns — both of whom are accused of a gross misuse of funds in a claim before the Federal Court — came with the blessing of the company’s head and regional offices.

MORE: Jeep trying to find vehicles loaned to celebrities

This included a $5-million deal with luxury Victorian retreat Villa Gusto, giving FCA exclusive access over three years, and a $20-million dealer information contract with website company Motortrak.

According to well-connected sources, both Campbell and Johns passed annual company audits into their financial management.

The bombshell revelation comes as the car company could face an unexpected tax bill of more than $4 million for hundreds of loan cars it handed out to celebrities, sports stars and VIPs over the past four years.

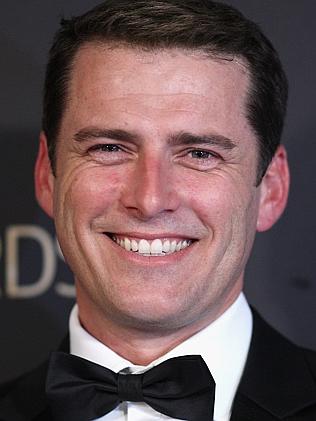

Jeep ambassador Karl Stefanovic. Picture: Getty Images Jeep ambassador Natalie Barr. Picture: Tara Croser

News Corp Australia understands the tax office had been contacting so-called “brand ambassadors” of Jeep, Chrysler, Fiat and Alfa Romeo vehicles and planned on slugging them with Fringe Benefits Tax, which is a tax on the personal use of a company car.

That was until it was pointed out by one savvy VIP that the provider of the vehicle — not the recipient — pays FBT on the personal use of a vehicle.

Most brand ambassadors — such as model Jesinta Campbell, TV personalities Cameron Williams, Natalie Barr and Deborah Knight, sports stars Shane Warne and Harry Kewell — were given Jeep or Chrysler vehicles valued between $50,000 and $70,000.

Because FBT is a flat rate 20 per cent of the value of the car per annum, it could leave distributor Fiat Chrysler Australia will a tax bill ranging from $3 million to $4.2 million for the hundreds of cars handed out over the past three years — some of which the company has lost track of, as so many were given out.

That figure does not include FBT on fuel cards and toll passes given with the cars to certain brand ambassadors.

Jeep ambassador Shane Warne. Jeep ambassador Harry Kewell. Picture: Kris Reichl

Tax office guidelines show FBT is applied to company cars at a statutory rate of 20 per cent “regardless of the distance travelled, to all car fringe benefits provided after 10 May 2011” — except where there is a pre-existing commitment in place to provide a car.

The price of a Jeep Grand Cherokee ranges from $50,000 to $75,000 while the price of a Chrysler 300C sedan ranges from $45,000 to $66,000 — 20 per cent of those amounts range from $9000 to $15,000 per car per year.

Tax expert Adrian Raftery, a senior lecturer at Deakin University, says if the brand ambassadors were considered employees of Fiat Chrysler then the company may be liable for FBT.

“It depends on what each individual contract says,” said Mr Raftery. “You don’t have to be paid a wage to be considered an employee or an associate of an employee.”

Jeep ambassador Cameron Williams Jeep ambassador Deborah Knight. Picture: Channel Nine

Mr Raftery confirmed that the car company — not the recipients of the vehicles — would be liable for any FBT that may be owing.

“If a fringe benefit has been provided, it is the responsibility of the provider or employer to pay the FBT,” said Mr Raftery.

A spokesman for FCA would not comment on the new claims.

A lawyer for Clyde Campbell said the claims against his client are “scandalous” and will be contested vigorously.

He is due to file his defence by July 24.

Originally published as Jeep tax battle over stars’ cars

Article published in The Herald Sun on 20 June 2015